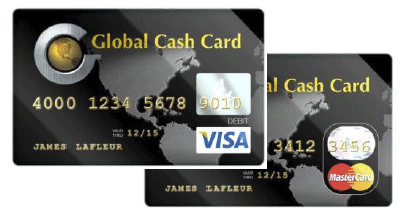

Cartão Global Cartão de Crédito

The Global Card credit card, available to customers around the world, with an online platform and digital system, Global Card, serves the most diverse people, within the most diverse credit perspectives and needs in the world.

The rates that are incurred and that apply to credit are quite attractive in the market, and suffer some variations depending on the country in which the customer is located, since the indexers are local, and there are variations according to the economy, with local market and with the currency in force in that country.

Cartão Global Cartão de Crédito – Learn more

In addition to the aforementioned advantages, Cartão Global Cartão de Crédito offers a series of benefits by associating with other companies of the most varied activities and segments, as it guarantees discounts and special payment conditions through established associations.

The global credit card is issued with the VISA brand and, therefore, has a high level of acceptance worldwide and can be used for various functions and purposes, And, nevertheless.

The limit available to be used to make withdrawals at ATMs in branches accredited for this purpose, and this by several countries of the world, and without the user having to pay more to have this Facility

To become a Global card customer, it is only necessary for the cardholder to open an account, and this can be done both through the official website and through the application, and enter the basic data that must be requested .

When it is approved in the review, the client must verify all the information so that there are no events without problems, and within a few days, which may vary according to the postal delivery service of the country in which the request was made. The user must Receive the Global Credit Card at the address requested at the time of the card request.

For more information on the Global Card credit card and to know all the terms and conditions of the international card, just visit the official website of the institution and make the request.